How Lookout Credit Union Reduced Healthcare Cost Increases by 75% - While Improving Benefits!

Lookout Credit Union’s health insurance costs were increasing dramatically year-over-year. They needed a better alternative.

Problem: Lookout Credit Union’s health insurance cost was increasing by 20% every year, which wasn’t sustainable for their business.

Solution: An H2B direct partnership agreement with their local hospital.

Results: Now, this community credit union’s healthcare costs increase by less than 5% annually. Even better? Their employees are more satisfied with the benefits and quality of care.

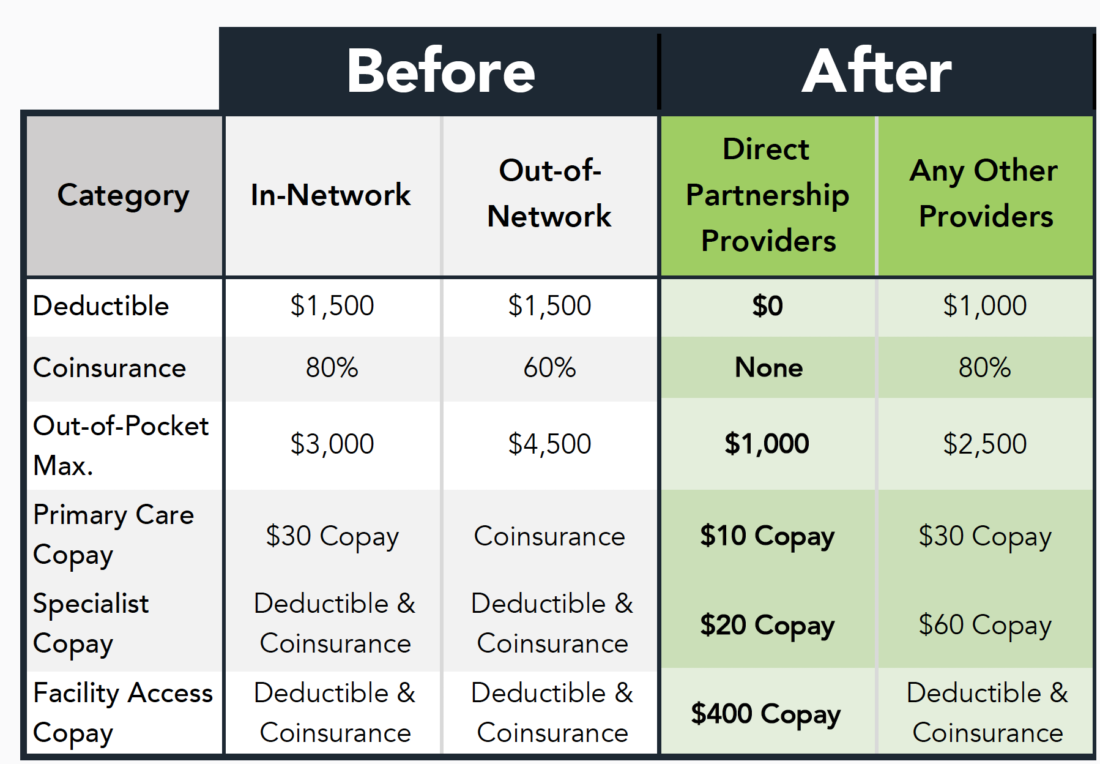

Before-and-After Plan Design: Traditional Carrier vs. H2B Direct Partnership

Lookout Credit Union’s Healthcare Story

Health insurance is one of the most expensive line items in many companies’ annual budget. Today, healthcare is often synonymous with health insurance, bringing to mind expensive premiums, high deductibles, and the hassle of finding in-network providers.

For many employers, this already significant expense gets pricier every year.

This is the situation Lynette Battson found herself in. As the Human Resources Director for Idaho-based Lookout Credit Union, she is responsible for the day-to-day oversight of their employee benefits and healthcare approach.

“Insurance was getting more and more costly,” she said. “We either had to take on more of that expense, or pass on that expense to our employees, which we really didn’t want to do.”

Three years into their H2B direct partnership, they’re still experiencing reduced costs, better benefits, and higher quality care. Here’s how:

WHAT IS A DIRECT PARTNERSHIP?

A direct partnership is simply a direct business relationship between an employer and their local healthcare provider that outlines how to access and pay for healthcare.

Often, companies access healthcare through Blue Cross, Cigna, Aetna, Humana, or other insurance arrangements. A direct partnership is an alternative to those carriers; it is not an insurance product. Instead, your company and the healthcare provider partner to create an agreement that is sustainable, affordable, and truly beneficial.

How Lookout Credit Union Transformed Their Healthcare

In 2017, the CEO of Lookout Credit Union and Lynette attended an educational event hosted by HealtH2Business (H2B). The key goals of a direct partnership – making healthcare sustainable for the employer and provider, and meaningful to employees – appealed to Lookout CU’s team.

After additional discussions, they decided to join the H2B direct partnership with their local hospital.

“The increases in our health insurance costs were averaging around 20% per year. It just wasn’t sustainable for us.”

-Lynette Battson, HR Director

“Finding the direct partnership option was a positive experience,” Lynette said. “Certainly, [joining the direct partnership] was a bit scary…but sometimes in life, you do those hard, scary things and give it a try.”

“We stuck with it,” she said. “It’s worked out well, and the team at H2B has been absolutely fantastic to work with.”

It’s safe to say that the decision they made three years ago to work directly with their local hospital was successful.

Today, Managing Healthcare is Easier and the Quality is Better

“Especially recently, I’ve had quite a few people come up to me and say how grateful they are for their healthcare plan and how easy it is to use,” she added. “It seems to be a little more personal to them than one of the big carriers. They’re really appreciative of the quality of care they’re getting, and the cost that it is to them.”

While it’s so important that employees are receiving high-quality care, it’s also important that the healthcare approach be manageable for the company.

When asked what it’s like to manage a direct partnership, Lynette says: “It’s really easy…even open enrollment.” This is in large part because the process of managing the plan is now more integrated and automated.

How Lookout Credit Union Actually Implemented a Direct Partnership

3 Key Benefits of the H2B Direct Partnership

Now in their third year as a member of the H2B direct partnership, Lookout CU experiences valuable benefits.

First, the cost of healthcare is much more affordable.

When they renewed last year, the cost increase was less than 5 percent.

“I go onto forums with other credit unions, and I see the kind of increases they’re experiencing,” Lynette noted. “I say ‘Well, ours was only 3 percent.’”

Plus, when Lookout Credit Union has a year with lower than expected utilization, any unused funds stay with the credit union. As Lynette said, “with a major carrier, if you have a good year, they don’t decrease your rates. There is no going backwards with a carrier like that.”

Second, Lookout Credit Union is now able to be actively involved in the plan administration.

“Being self-funded, we do have a say, we do have a voice, and we can advocate for our employees when we need to.”

-Lynette Battson, HR Director

“We do have those special circumstances and, when you’re with a major carriers, you don’t really get a say. You don’t really have a voice.”

Finally, the quality of care has definitely changed for the better.

“It’s almost like, because of the partnership, we get treated as a VIP when we go to those facilities,” Lynette shared. “I think they realize that we’ve got this partnership, and we’re all working in it together. We do maybe get a little extra TLC when we go to our partners.”

She adds that it’s important to have a good third-party administrator, or TPA, to aid in implementing and administering the plan from a financial perspective.

“Give It A Look”

While this has been a valuable change for Lynette and the team at Lookout Credit Union, could the direct partnership work for other employers?

“Absolutely,” says Lynette. “I think they would be crazy to not give it a look and at least try it for a year.”

“I wish we’d known about this earlier and done it sooner!”